It was interesting to see more investors attending this year’s CPI Global Summit, probably being based in New York, but also, out of conversation, investors wishing to understand the commercial payments market more so. In comparison, we recently attended a Fintech Forum in Manchester, where it was clear that many Fintechs focused on retail, leveraging Open Banking, acting as Third Party Provider (TPP) in PSD2 speak, challenged in that Open Banking has a played out slower than expected due to customer habits. The Fintech Forum was attended by investors too.

Once again, the customer experience was absolutely at the heart of discussion, looking across the supply chain, such as banks, corporates, travellers, and suppliers, in terms of pain points, how expectations are reset by the innovations people enjoy personally, especially with mobile, and the opportunities that come by adopting payment methods like virtual payments. One challenge stems from having a myriad of payment options, each with their own strengths and weaknesses, with no single solution being usable across the board, by either sides of what is a two-sided market, that is between buyers and suppliers, for their accounts payable or receivable.

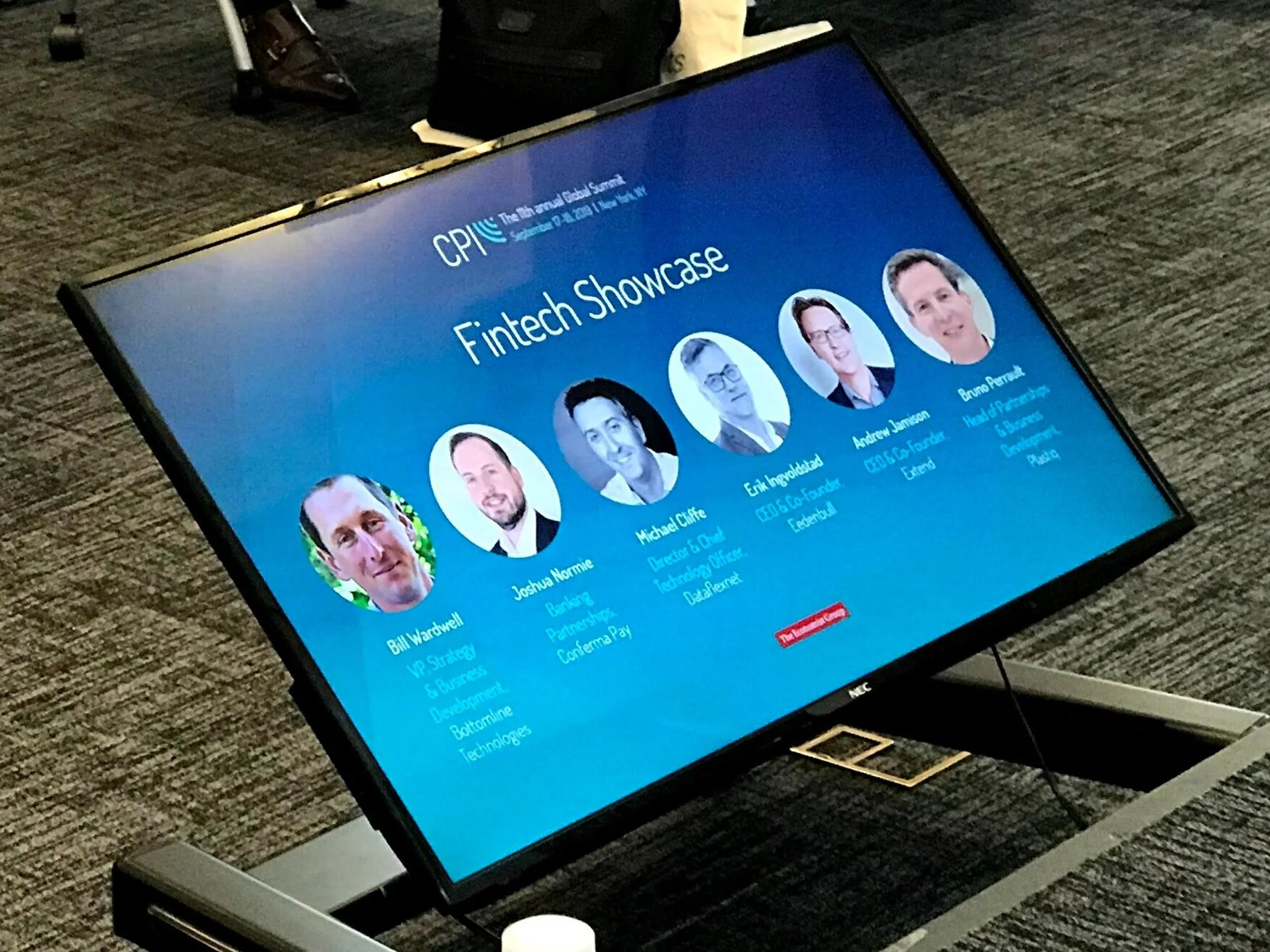

Dataflexnet joined the Fintech showcase and panel discussions, providing an update on the positive reception SharePay has received, and walking through the roadmap ahead, and how this has been integrated into virtual payments.

You can read more about all this from CPI themselves here.

Dataflexnet, as a long term Sponsor of the Commercial Payment Summits, looks forward to the CPI Middle East & Africa Summit event at the Shangri-La hotel venue.